Communist Bernie Sanders seeking nomination from the Democrat Party for the 2020 presidential election has repeatedly complained about the wealth that “one percent of the one percent” people possess. In nearly all campaigns, he has demonized the “billionaire status” success some people have achieved despite many of them coming from very modest backgrounds such as Howard Schultz and Michael Bloomberg. He went on to seed the idea among hundreds of millions of Americans that no one should be able to become a billionaire. At the same time, capitalist legendary investor Berkshire Hathaway chairman Warren Buffett has repeatedly criticized the low tax that he pays. The solution is simple.

“If Buffett is so unhappy that he pays less in tax and Bernie is furiously unhappy that billionaires pay very little tax, why not create a system that taxes the “1% of the 1%” on the asset value of their all securities holdings. In this way, billionaires like Buffett will be enabled to pay more of what they own in wealth without even affecting their earned income.”

For everyone to understand, let’s cite Robert Kiyosaki’s famous book Rich Dad Poor Dad. Americans largely derive income from four sources. Out of the four, two major ones are 1) employment and 2) investment. Employment income is very hard-earned income that pays just enough to pay bills. Investment creates wealth. The difference between these two is gigantic which Bernie needs to understand. People with employment income only tend to live paycheck to paycheck. If they lose their job, they fall into poverty or homelessness quickly. On the other hand, people with investment holdings rarely face that level of severe financial problems. Buffett is one of the wealthiest men in the world not because of how much money he has in the bank account or how much he draws in salary. He is rich because of the asset value of the securities that he owns. To put it into perspective, he does not spend 9-5 working to earn billions of dollars a month; the securities value appreciates even when he is not working or just sleeping. Compare that to an average Joe who works at McDonald’s. He works eight hours a day and gets paid for each hour in fixed compensation. This person earns a salary but doesn’t gain anything while he flips burgers since he has no assets in securities. In a study conducted by MoneyCrashers, it was found that individuals with higher incomes tend to invest their money in the stock market. Only 30% of people earning less than $20,000 per year reported they are investing in the stock market. Compare that with the 92% of those earning $250,0000 or more. Most people like Joe fall in the low-income category who “must allocate a greater portion of their take-home pay toward necessities such as food, housing, utilities, health care, and transportation”. High income earners are more likely to invest because they have more discretionary income, which they can save and invest for the future. This is the key driver of the wealth gap that Bernie apparently doesn’t understand.

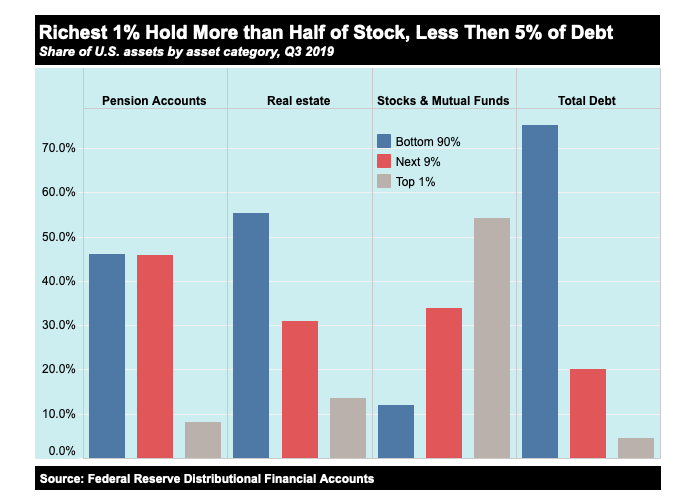

According to the Federal Reserve, although the household wealth has increased from $56.8 trillion to $107.1 trillion over the past decade, only 2% of the growth in wealth has gone to the bottom 50% of the population, while nearly 72% went to the wealthiest 10%.

Buffett and many tax pundits talk about the ordinary income tax and capital gains tax rates. However, they don’t talk about the taxation of the asset value held as securities. Most of the wealth is the “value of the asset” but the conversation around “gains” in assets for taxation is misleading. It is unlikely that any billionaire in this country would sell all their assets in securities. For example, in order to pay capital gain taxes, Buffet would have to sell his shares of Berkshire Hathaway. Why would he do that though? Would Jeff Bezos sell all his shares of Amazon? Of course not. If the shares are not sold, there is no taxable event, hence no tax bill. Still, they are able to use and pledge their securities holdings just like any other asset. Imagine if Buffett could pay a 5% tax on his asset of $80 billion, $4 billion could be added to the US treasury and subsequently deployed for necessary government funded programs. Considering how unhappy Buffett is paying little in tax, Bernie should provide him relief by sponsoring a bill that would tax Buffett on the asset value of the securities.

__________

Further reading on inequality and the stock market

The steady increase in U.S. income inequality from the 1970s through the early 2000s was accompanied by strong gains in the stock market. The S&P 500 composite index grew from 92 in 1977 to over 1476 in 2007—about a 140 percent increase. These gains were huge. By comparison, the gains in the prior 30 years (1947-77) were only 50 percent. The correlation between the Gini coefficient and stock prices from 1947 to 2013 is strongly positive. As stock prices rise, the gains are disproportionately distributed to the wealthy. Lower- and middle-income families who are also wealth-poor are less likely to expose their savings to the higher risks of equity markets. – Fed Reserve of St Louis

Disclaimer: I am not a fan of the tax suggested above. Instead of complaining about how much less in taxes he pays, Buffett should encourage his portfolio companies to increase the salaries of their employees and better yet grant stocks in the company so that all employees at least have an exposure to the asset that Buffett owns.