Supreme Court ruled that online sales should be taxed. It’s still not implemented well. Online-only sellers continue to avoid collecting or paying sales tax whereas businesses with operations in-state must collect taxes.

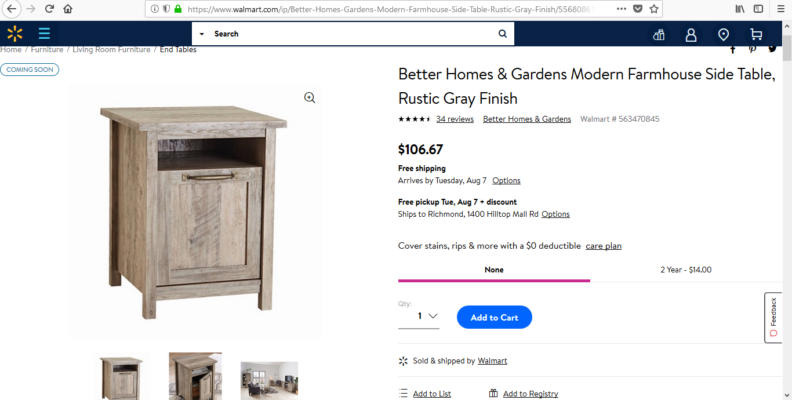

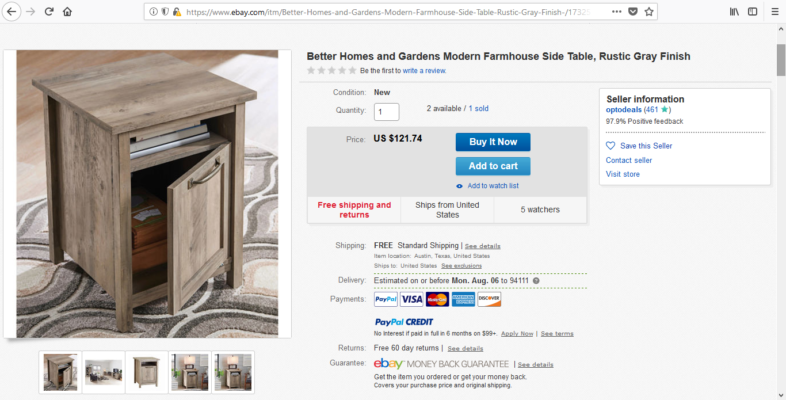

Let’s look at an example product:

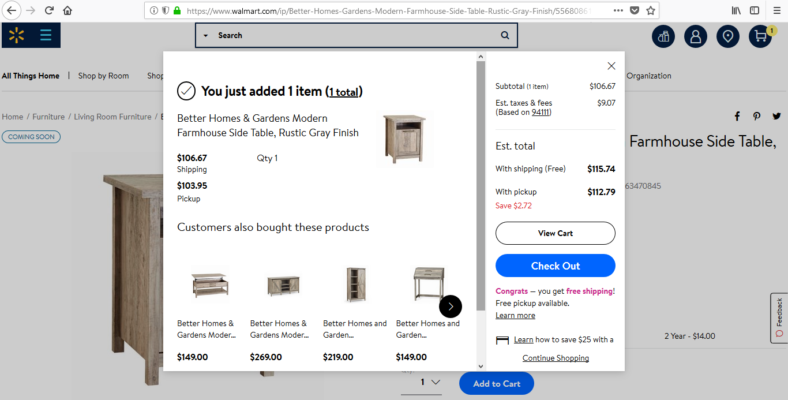

If you buy from Walmart, this is what happens:

1) Walmart gets $106.67

2) Government gets $9.07

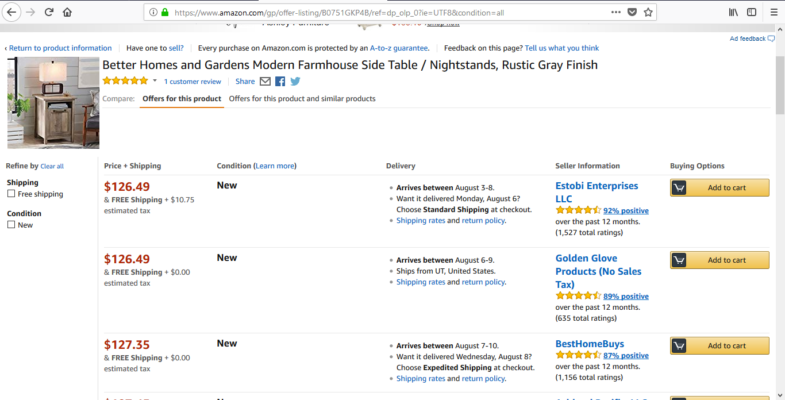

In this case, Amazon collects 15% of the product price. This is what happens:

1) Amazon gets $18.97

2) Seller gets $109.51

3) Government gets $0

If you buy from eBay, this is what happens:

- eBay gets $12.17

- Seller gets $109.57

- Government gets $0

Overall, two cases are seen:

- Large businesses with physical presence, in this case Walmart, are able to sell at a cheaper price than online competitors because of scale or because they are able to cut the middle men, such as eBay and Amazon.

- Businesses with physical presence, usually smaller shops, are not able to sell at a price cheaper than online only stores because they do not have the scale like Walmart and they must collect sales tax. These are the typical stores going bankrupt because they operate in environment that puts them at a serious disadvantage.

In the past two decades, consumers have become comfortable with the idea of avoiding sales tax if they choose to shop online. Internet businesses have been created on the tax avoidance premise (like Wayfair which advertised that you should buy from them so that you don’t have to pay tax). Several apps have been created for a consumer to scan the barcode of a product and find the online price when they are shopping at a local store. You like something, just order online at a cheaper price or at least avoid tax.

An internet only seller must also collect sales tax on every product just like a local business does regardless of their sales volume. Only then it would be a fair treatment.